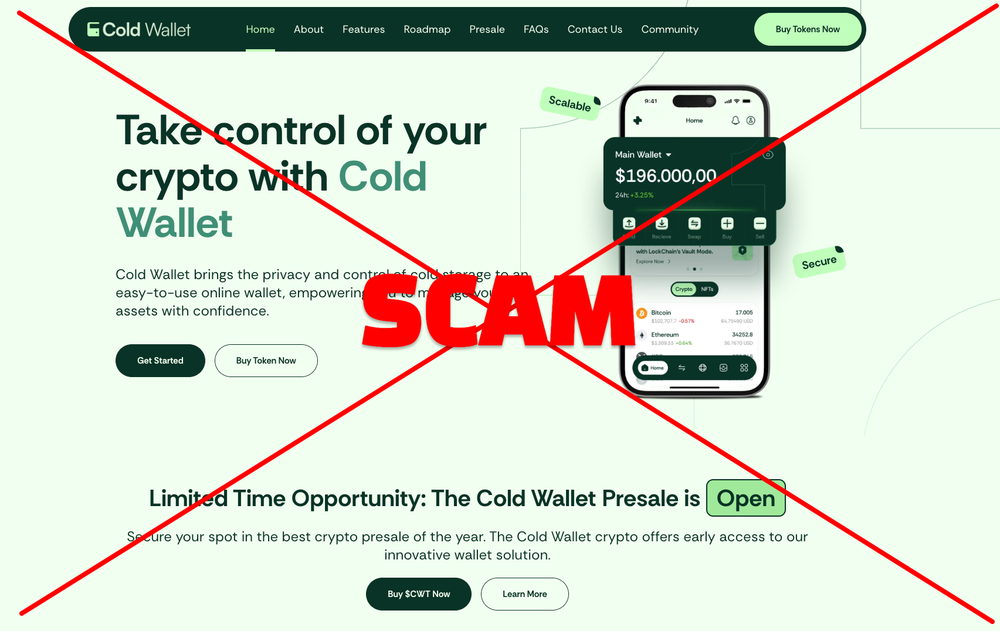

INVESTOR ALERT: Deconstructing the "Cold Wallet" (CWT) ICO Impostor Scam

ntroduction: Hype, Hope, or High Risk?

The cryptocurrency market is a landscape of immense opportunity, but its largely unregulated nature also makes it a fertile ground for sophisticated fraud.1 Initial Coin Offerings (ICOs) are particularly vulnerable, allowing malicious actors to raise millions of dollars on the back of compelling promises before disappearing without a trace.2 The "Cold Wallet" (CWT) ICO is a textbook case study in modern crypto deception, presenting itself as a revolutionary, privacy-focused project while exhibiting a cascade of red flags that point to a calculated scam.

This report provides a forensic analysis of the CWT project, deconstructing its marketing pitch and exposing the deceptive tactics it employs. From an anonymous team and promises of impossible returns to the more insidious strategy of brand and ticker impersonation, this investigation will demonstrate how CWT has been engineered to exploit investor trust. By understanding the anatomy of this specific scheme, investors can better equip themselves with the tools to identify and avoid similar fraudulent offerings in the future.

The Alluring Pitch: Preying on the Need for Privacy

The CWT project's marketing is expertly designed to capitalize on a legitimate and growing concern within the crypto community: privacy and security.3 Its promotional materials paint a picture of a next-generation, non-custodial wallet built on a foundation of cutting-edge technology.3

The core claims are engineered to inspire confidence and create a sense of urgency:

- Advanced Privacy: The project purports to use Zero-Knowledge Proofs (ZKPs), a sophisticated cryptographic method, to enable completely anonymous transactions and shield user data from surveillance.5

- A Full Ecosystem: Beyond a simple wallet, CWT promises a launchpad for new crypto projects, staking rewards for token holders, and a Decentralized Autonomous Organization (DAO) for community governance.3

- Astronomical Returns: The marketing is supercharged with the promise of life-changing profits. Promotional articles and the project's own materials frequently cite a projected launch price of around $0.35, which, compared to presale prices as low as $0.007, implies a potential return on investment (ROI) of over 4,900%.3

This combination of a compelling, privacy-focused narrative and the lure of exponential gains is a potent formula for attracting capital quickly, especially from investors driven by the Fear Of Missing Out (FOMO).3

A Pattern of Definitive Red Flags

While the pitch is alluring, the project's foundations crumble under basic scrutiny. CWT exhibits a collection of the most critical red flags associated with fraudulent crypto offerings. These are not minor oversights but deliberate choices indicative of malicious intent.3

The Anonymous Team: A Foundation of Zero Accountability

One of the most significant and non-negotiable red flags in the crypto space is a completely anonymous founding team.3 Legitimate projects are built on the reputation and expertise of their creators, who are legally and professionally accountable for their actions.9 In stark contrast, the CWT project offers zero transparency regarding its team. There are no names, no professional profiles, and no documented track records in blockchain development or cybersecurity.3

This total anonymity makes accountability impossible. Investors are asked to entrust their funds to a faceless organization with no legal presence. Should the project fail or the funds disappear—the most likely outcome—investors have no legal recourse.2

The Phantom Audit: Security Claims Without Proof

For any project, but especially one whose entire value proposition is built on "ironclad privacy" and security, independent smart contract audits are non-negotiable.3 Reputable third-party firms conduct rigorous code reviews to identify vulnerabilities and potential backdoors.

The CWT project makes unsubstantiated claims that its smart contracts have been audited by well-known firms like Hacken and CertiK.11 However, there is no verifiable evidence to support this. The project's website and marketing materials provide no links to public audit reports, and no such reports are available on the auditors' official websites.3 Investing in a project with unaudited smart contracts is profoundly risky and a fundamental failure of due diligence.

The Ticker Heist: Deliberate Brand and Ticker Confusion

Perhaps the most damning evidence of CWT's fraudulent nature is its deliberate use of a non-unique ticker symbol to create confusion and mislead investors.3 The ticker "CWT" is already associated with several distinct and unrelated entities, a fact the project's creators have weaponized to their advantage.

The existing entities using the "CWT" ticker include:

- CoinW Token (CWT): The native token of the CoinW cryptocurrency exchange. It is an established ERC20 token with a documented history and active trading pairs.12

- CrossWallet (CWT): A separate crypto wallet project with its own token, listed on exchanges like Bitget, with its own distinct tokenomics and project goals.13

- CWT (the company): A major global travel management company, formerly known as Carlson Wagonlit Travel, with no connection to cryptocurrency.16

This overlapping branding creates a "cloud of legitimacy" that benefits the scam. An investor performing a cursory online search for "CWT token review" is likely to encounter information related to the legitimate entities, creating the false impression that the new ICO is an established project.3 This is a sophisticated form of deception designed to hijack the brand recognition of others.

Predatory Tokenomics: The 4,900% ROI Promise

The final pillar of the CWT scam is its predatory economic model. The project consistently advertises projected returns of over 4,900%, a figure designed to override rational judgment.3 Financial regulators have repeatedly warned investors that promises of "guaranteed" or exceptionally high returns are a classic hallmark of investment fraud.18

In the context of an ICO, such promises are indicative of a planned "pump-and-dump" scheme. Academic research has shown that projects with large presale discounts often result in early investors "flipping" their tokens for a quick profit immediately after the public launch, causing the price to crash and leaving later retail investors with significant losses.21 The tokenomics of CWT appear engineered for this exact outcome, allowing the anonymous founders to extract all invested capital and leave their victims with worthless tokens.

Verdict: A Classic Impostor Scam

When analyzed in its totality, the "Cold Wallet" (CWT) ICO is not a legitimate, high-risk investment opportunity. It is a calculated and multifaceted impostor scam. The project's entire operational framework is built on deception: an anonymous team provides zero accountability, unsubstantiated audit claims create a false sense of security, predatory tokenomics promise impossible returns, and the deliberate hijacking of an existing ticker symbol is designed to mislead and confuse. The project has no verifiable substance, no proven technology, and no credible team. Its sole purpose appears to be the extraction of funds from unwary investors before an inevitable exit.

How to Protect Yourself and Report Fraud

To combat these tactics, investors must adopt a mindset of skepticism and verify every claim independently. Before investing in any ICO, ask these critical questions:

- Is the team public and verifiable? Research the founders' professional histories on sites like LinkedIn. Anonymous teams are a major red flag.3

- Is the smart contract audited? Demand a public, verifiable audit report from a reputable firm. Claims without proof are worthless.3

- Are the ROI promises realistic? Be extremely wary of any project guaranteeing massive or "guaranteed" returns. Such claims are a hallmark of fraud.18

- Is the branding unique? Search the project name and ticker symbol to see if they are impersonating other legitimate entities.3

- Is there a working product? Be cautious of projects that have strong marketing but no tangible, verifiable product or publicly accessible MVP.3

If you believe you have fallen victim to this or a similar scam, it is crucial to report it to the proper authorities. Reporting helps law enforcement track criminal networks and can prevent others from being victimized.

Official reports can be filed with the following U.S. agencies:

- The Federal Trade Commission (FTC) at ReportFraud.ftc.gov

- The Commodity Futures Trading Commission (CFTC) at CFTC.gov/complaint

- The U.S. Securities and Exchange Commission (SEC) at sec.gov/tcr

- The Internet Crime Complaint Center (IC3) at ic3.gov/Home/FileComplaint19

For information or recommendation on where to invest, or if you have a watchdog report please email us at: report@cyprus-insider.com

Works cited

- How to Spot Crypto Scams and Avoid Them: A Trader's Guide - Coinrule, accessed September 5, 2025, https://coinrule.com/blog/learn/how-to-spot-crypto-scams-and-avoid-them-a-traders-guide/

- ICO Explained: What It Is and Successful Examples - Investopedia, accessed September 5, 2025, https://www.investopedia.com/terms/i/initial-coin-offering-ico.asp

- Cold Wallet (CWT) ICO Review: Hype, Hope, or High Risk?, accessed September 5, 2025, https://www.cyprus-insider.com/cold-wallet-cwt-ico-review-hype-hope-or-high-risk/

- Cold Wallet price today, CWT to USD live price, marketcap and chart | CoinMarketCap, accessed September 5, 2025, https://coinmarketcap.com/currencies/cold-wallet/

- Cold Wallet Launches Privacy-First $CWT Token: Here's How Early Holders Could See 100x Returns! - CoinCentral, accessed September 5, 2025, https://coincentral.com/cold-wallet-launches-privacy-first-cwt-token-heres-how-early-holders-could-see-100x-returns/

- Cold Wallet Tackles Web3 Privacy Issues: Experts Predict This ICO Could Be the Next Breakout Crypto! - CoinCentral, accessed September 5, 2025, https://coincentral.com/cold-wallet-tackles-web3-privacy-issues-experts-predict-this-ico-could-be-the-next-breakout-crypto/

- How to Spot a Crypto Scam: The Top Red Flags to Watch For | McAfee Blog, accessed September 5, 2025, https://www.mcafee.com/blogs/internet-security/how-to-spot-a-crypto-scam-the-top-red-flags-to-watch-for/

- 5 Crypto Red Flags: What to Look Out For Before You Invest - TokenMinds, accessed September 5, 2025, https://tokenminds.co/blog/crypto-learning/red-flags-to-spot-before-investing-in-a-crypto-project

- Rug Pull Scams - DataVisor, accessed September 5, 2025, https://www.datavisor.com/wiki/rug-pull-scams

- Cryptocurrency Scams: How to Spot, Report, and Avoid Them - Investopedia, accessed September 5, 2025, https://www.investopedia.com/articles/forex/042315/beware-these-five-bitcoin-scams.asp

- The Strategic Case for Cold Wallet (CWT): Early Participation as a Path to Long-Term Value in a Fragmented Crypto Market | Bitget News, accessed September 5, 2025, https://www.bitget.com/news/detail/12560604933299

- CoinW Token price today, CWT to USD live price, marketcap and chart | CoinMarketCap, accessed September 5, 2025, https://coinmarketcap.com/currencies/coinw-token/

- What is CrossWallet (CWT)| How To Get & Use CrossWallet ... - Bitget, accessed September 5, 2025, https://www.bitget.com/price/crosswallet/what-is

- CrossWallet price today, CWT to USD live price, marketcap and chart | CoinMarketCap, accessed September 5, 2025, https://coinmarketcap.com/currencies/crosswallet/

- CrossWallet Price, CWT Price, Live Charts, and Marketcap - Coinbase, accessed September 5, 2025, https://www.coinbase.com/price/crosswallet

- CWT (company) - Wikipedia, accessed September 5, 2025, https://en.wikipedia.org/wiki/CWT_(company)

- Our history - CWT, accessed September 5, 2025, https://www.mycwt.com/why-cwt/our-history/

- Investor Alert: Watch Out for Fraudulent Digital Asset and “Crypto” Trading Websites, accessed September 5, 2025, https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-alerts/investor-alert-watch-out-fraudulent-digital-asset-and-crypto-trading-websites

- What To Know About Cryptocurrency and Scams - Federal Trade Commission, accessed September 5, 2025, https://consumer.ftc.gov/articles/what-know-about-cryptocurrency-scams

- Curious About Crypto? Watch Out for Red Flags - Commodity Futures Trading Commission, accessed September 5, 2025, https://www.cftc.gov/sites/default/files/2022-10/DigitalAssetRedFlags.pdf

- ICO investors - PMC - PubMed Central, accessed September 5, 2025, https://pmc.ncbi.nlm.nih.gov/articles/PMC8591750/

- ICO Due Diligence: A Checklist for Evaluating Initial Coin Offerings | by FYNZON | Medium, accessed September 5, 2025, https://fynzon.medium.com/ico-due-diligence-a-checklist-for-evaluating-initial-coin-offerings-f431e5bf2a56

- Beware Cryptocurrency Scams - Mass.gov, accessed September 5, 2025, https://www.mass.gov/info-details/beware-cryptocurrency-scams

Please note that direct URLs to all specific articles are numerous and can change. The descriptions above indicate the type and nature of the sources used for the September 2025 assessment.